Jesus Christ. What has happened to the crypto markets since the New Year?

There is literally blood on the streets.

Bitcoin (BTC) is down to USD 9,000 from highs of around USD 20,000 and the whole of the top 100 on coinmarketcap.com are also down at least 50% from their highs just a month ago.

Coins like Ripple are down more than this. XRP was around USD 3.65 on 8th Jan and now it’s trading at USD 0.8. If you’ve bought at the high, then you’re licking your wounds. Hope that you haven’t lost too much.

The crypto markets are shitting themselves.

The newest money that piled in at the end of 2017 have dashed, or they’re holding on whilst their assets have more than halved in a month.

That’s the volatility of these markets.

It’s clear that fear has taken over.

Every day, there’s talk of a regulatory crackdown. Or there’s been a hack of an exchange (Coincheck). Or there’s a scam behind a coin (Tether and Bitfinex).

Why wouldn’t you be shitting yourself? Pundits are now talking about Bitcoin going down to zero.

Are they all wrong? Is it possible that they’re right and I’m wrong? Am I just being a fanatic by thinking that this is just noise and that this will just blow over?

Perhaps.

I’m certainly not thinking about selling my house and putting it into crypto.

But maybe the fear has been overdone.

Let’s look at it from a different angle.

Have the projects themselves changed in the last month? No. They’ve very probably carried on working and developing. Monero’s developers haven’t been standing still whilst the markets shat themselves. They’ve been improving their code and making new features.

Value and price are different things. To quote Buffett again: Price is what you pay, value is what you get.

The value of the underlying has only been increasing in the last month.

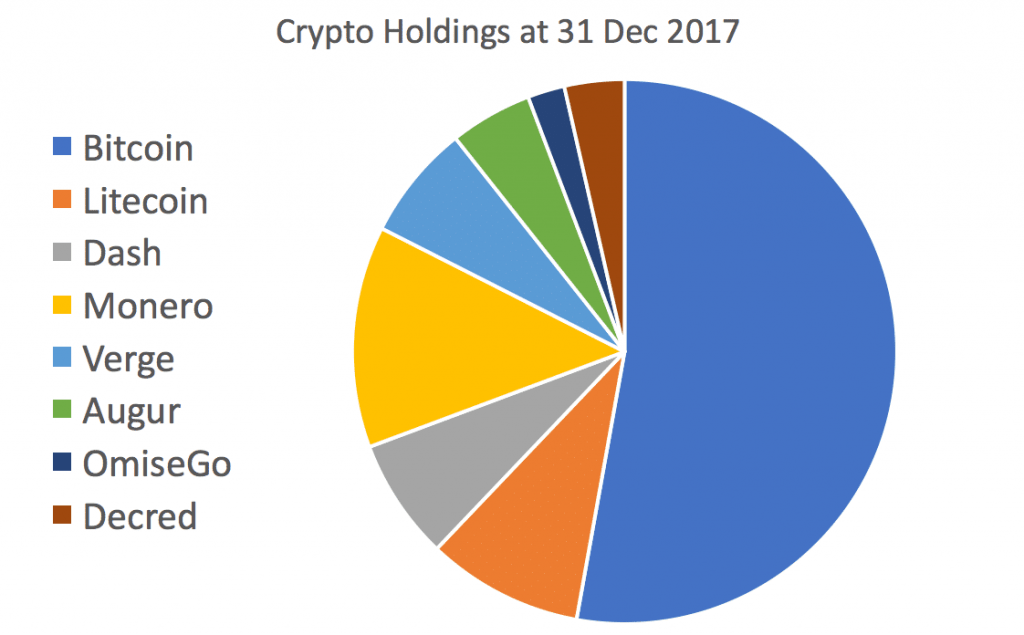

Developers must have been working behind the scenes, at Decred, Bitcoin, Augur, OmiseGo, Cardano. Everywhere. These projects must all be better than they were a month ago.

The real questions are:

- Are the fears about regulatory crackdowns real?

- And if not, then have crypto prices gone down too far vs this risk?

Are the fears about regulatory crackdowns real?

The worst case scenario is that all governments around the world ban and criminalise holding and trading any crypto asset. This would mean that I could be sent to jail for holding and trading Bitcoin. Likelihood = low. Different countries have different approaches to crypto. See this wiki article about different countries’ approaches. This means it’s likely that some countries would be pro-crypto.

The next worst case scenario is that your own country bans crypto. I’m in the UK and I don’t think that this would happen. From the same wiki article above:

“As of 2017, the government of the United Kingdom has stated that bitcoin is unregulated and that it is treated as a ‘foreign currency’ for most purposes, including VAT/GST.

Bitcoin is treated as ‘private money’. When bitcoin is exchanged for sterling or for foreign currencies, such as euro or dollar, no VAT will be due on the value of the bitcoins themselves. However, in all instances, VAT will be due in the normal way from suppliers of any goods or services sold in exchange for bitcoin or other similar cryptocurrency. Profits and losses on cryptocurrencies are subject to capital gains tax.”

It doesn’t look like from the above that Bitcoin or other cryptos are viewed as heinous in the UK and I think therefore that it’s unlikely to be banned in the UK.

And if not, then have crypto prices gone down too far vs this risk?

If we think that people see this regulatory risk as real, then we can assume that this is baked into the current prices of cryptos.

I.e. if the regulatory risk was removed or felt by investors to have been removed, then we might think that the prices will increase towards previous levels.

Is this as far down as we’re likely to see it?

Let’s look at Bitcoin as a proxy for the entire crypto market. The chart below from coinmarketcap.com is for the last year:

Look at the grey bars at the beginning between 6th Nov 2017 and 29th Jan 2018. That’s volume. That’s the amount of Bitcoin that changed hands. Compare that to the date period to the left of that. The volumes really only started picking up in November. That volume we might think is new money. Retail investors who have piled in with FOMO. Now these same new retail investors AKA weak hands have been shaken out.

Where is the support level?

If we go by the volume example above, we might think that the price level before volumes became enormous (relatively), would be a good guide:

I’m going to call it as the bottom price levels that we could expect are around USD 5,000. From here, it will be about building momentum again and positive news around crypto.

Should you wait for that? I’m not sure as it may never get down to those levels again, and so it might be worth a nibble at these prices to at least get a measure of cheapness.

What do you think? Let me know in the comments below.