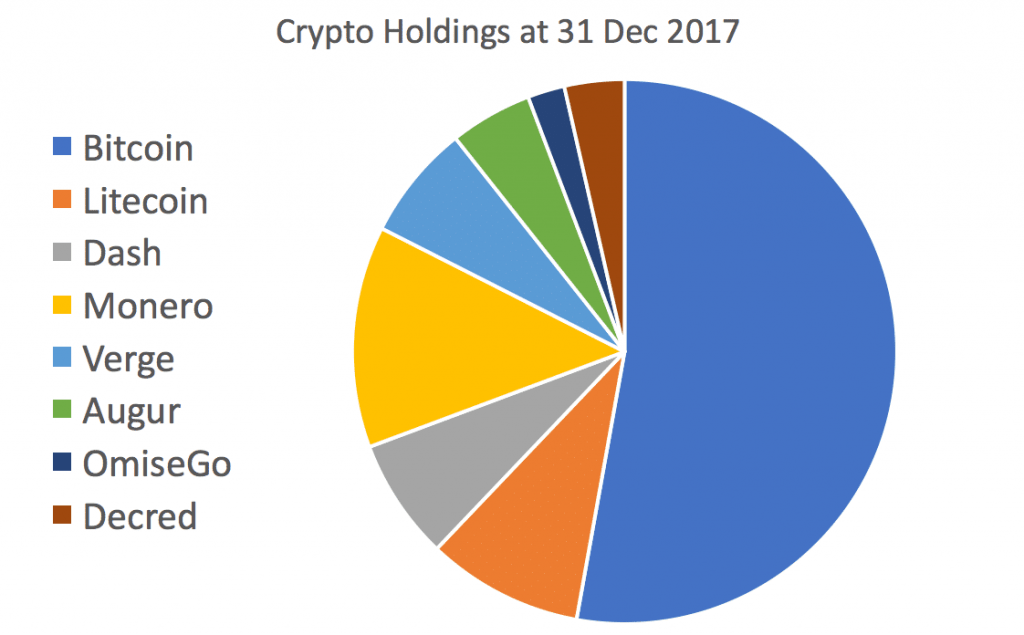

In my last post, I detailed my crypto portfolio as at 31 December 2017.

I think it’s pretty solid and it’s made some good gains, and I think it’s set up for some good gains in 2018. But I’m not sure it’s going to 10x in 2018.

Let’s take a look at my portfolio again:

I still want to Protect The Downside

One of Warren Buffett’s maxims is Don’t Lose Money. He says to ‘protect the downside’. This is because losing money makes it mathematically harder to make your money back.

If the value of your portfolio goes down by 50%, to get back to where it was, it needs to increase by 100%.

That’s why not losing money is Buffett’s starting principle.

(Now he might laugh about the idea of protecting your downside within cryptocurrencies but that’s another question!)

I think that my portfolio above is pretty good at protecting the downside. I see steady gains for all the coins above with the exception of Verge. Verge is a highly speculative play for me. (See how and why I bought Verge here)

But I want to increase my risk and therefore my chance of reward

It’s so easy to get caught up in the frenzy that we’ve seen in late 2017 and even in the last two weeks. Three friends have suddenly started buying cryptocurrencies, using Coinbase and Binance to buy Ripple etc.

Some coins are seeing 200% to 1,000% rises.

That makes me question my asset allocation.

Is my split too conservative by crypto standards? Am I missing out on potentially life-changing amounts of gains by playing it too safe?

The portfolio above is solid and if you bought the same split today, I would think that you wouldn’t lose money in 2018 and you might make 10x. But are there more gains out there? Am I being too greedy? Are we definitely in bubble territory now? (A classic oft-quoted example of bubble territory is when your taxi driver asks you for stock tips. Translate that to crypto and the equivalent is when The Sun tabloid starts giving in-depth guides to cryptos like Verge (XVG) and Stellar (XLM))

I want to add some risk to my portfolio but not so much that I fail to protect the downside

What’s the spice and how much to allocate to it

I’m going to add 15% – 20% of my portfolio into riskier coins which have the chance to at least 10x from here and that could actually return even more.

On 3rd Jan 2018, I deposited some Bitcoin onto Binance and bought a nibble of Cardano (ADA), Ripple (XRP) and some Stellar Lumens (XLM).

Yes there was certainly some FOMO in those buys but the amounts I’ve put in aren’t big enough to risk my downside. Their prices have dropped off a bit since the 3rd and I might buy a bit more of each to dollar cost average my entry price and I’ll write up how and why I bought these in subsequent posts.

Coins that are on my imminent watchlist

- Binance (BNB)

- Dragonchain (DRGN)

- Kucoin (KCS)

What’s on your watchlist for 2018? Let me know in the comments below!